With 117.4 million active mobile connections in early 2024—99.3% of the total population—the Philippines is nearly fully connected. This level of digital access is driving profound changes in consumer behavior and fueling one of the most exciting digital markets in Southeast Asia. Looking at the Philippines Consumer Tech Trends, Filipinos spend an average of 10 hours online each day, one of the highest rates in the world. Whether it’s browsing social media, shopping online, or using mobile apps, digital technology is deeply woven into everyday life.

Philippines Consumer Tech Trends Show a Thriving Market

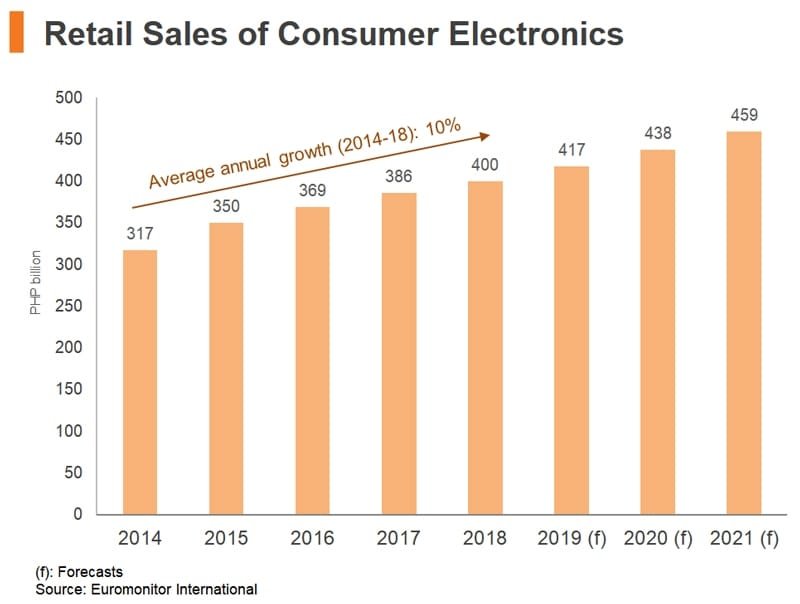

The Philippines consumer electronics market was worth USD 10.24 billion in 2024. It’s projected to grow to USD 17.48 billion by 2033, at a steady CAGR of 6.14%. Much of this growth comes from strong demand for smartphones, wearables, and smart home devices.

Mobile devices alone account for over 55% of all consumer electronics spending. In a population of around 100 million, 44 million Filipinos already own smartphones—and that number keeps growing. This rapid growth shows that the Philippines Consumer Tech Trends are not just about gadgets; they reflect how people live, work, shop, and connect.

Read Also: Trends & Insights in the Philippines Marketing Strategies 2025

E-commerce Growth Mirrors Digital Device Use

E-commerce is another major force in this digital transformation. The Philippines reached a gross merchandise value (GMV) of USD 15 billion in 2022, and that’s expected to quadruple to USD 60 billion by 2030. Platforms like Shopee and Lazada lead the way, making online shopping more accessible nationwide.

With more Filipinos using smartphones and digital payment apps, online shopping is becoming the default. At least 75% of consumer journeys—before and after purchase—now happen online. And 77% of shoppers use social media and e-commerce platforms to discover and evaluate products.

Philippines Consumer Tech Trends: Digital Finance Takes Center Stage

Another key shift is in how Filipinos handle money. Fintech apps are booming. By the end of 2024, 79.5% of Filipinos aged 15 and above—that’s about 66.4 million users—are expected to use mobile financial services.

This includes digital wallets (27.2%), digital commerce (34%), and online banking (8.6%). These tools make it easier to shop, pay bills, send money, and save—all from a smartphone. The rising use of fintech shows how Philippines Consumer Tech Trends go beyond convenience—they’re reshaping financial behavior and access.

Read Also: See Philippines Digital Economy Growth: Surprising Trends!

The Internet Economy Is a Major Growth Engine

The digital economy is already making a significant contribution to the national economy. In 2023, the gross value of the Philippines’ internet economy reached PHP 2.05 trillion (about USD 35.26 billion). With increasing investments in digital infrastructure and widespread mobile access, this number is expected to grow even more in the coming years.

A New Digital Consumer Landscape

The country now has 69 million digital consumers, making it the second-largest digital population in Southeast Asia. What sets Filipino consumers apart is their deep digital engagement across all stages of the buying process. From watching reviews on YouTube to comparing prices on apps and paying via e-wallets, every step of the journey is happening online. And with ongoing investment in tech and fintech, this digital lifestyle is only accelerating.

What’s Ahead for Philippines Consumer Tech Trends?

The Philippines Consumer Tech Trends show no signs of slowing. With strong mobile penetration, fast-growing e-commerce, and widespread fintech adoption, the country is setting the pace for digital transformation in the region. Businesses that want to succeed must understand this new landscape—where the smartphone is the main gateway to commerce, finance, and communication. For brands, tech firms, and marketers, the message is clear: adapt to the digital-first behavior of Filipino consumers—or risk being left behind.