With 142 million mobile connections (or 122% of the population), the Philippines has become one of Southeast Asia’s fastest-moving digital economies. Multiple accounts per person are now common, as users manage both personal and business transactions through mobile devices. These numbers define today’s Philippines Mobile Money Trends, where digital wallets and fintech solutions are shaping how Filipinos handle their money.

The Rise of Mobile Access in the Philippines Mobile Money Trends

Smartphone penetration stands at 73%, making mobile access nearly universal. Yet, financial inclusion still has room to grow. About 28% of Filipinos remain unbanked and 37% underbanked. For many in rural areas, mobile wallets like GCash and Maya Pay are not just convenient—they are essential. These tools bridge the gap between people and financial services that used to be out of reach.

Read Also: Philippines Rural Economy Digitization Unleashed

As smartphones and internet access spread, the Philippines is rapidly shifting from a cash-based society to a digital-first economy. This shift isn’t just about convenience—it’s about opportunity and empowerment for millions.

Explosive Fintech Market Growth

The Philippines Mobile Money Trends also see a boom in the fintech market. From USD 984.6 million in 2024, it’s expected to surge to USD 4,656.5 million by 2033, growing at a powerful 16.81% annual rate.

The Bangko Sentral ng Pilipinas (BSP) has played a key role by approving new digital banking licenses and promoting interoperable systems such as QR Ph, which links payments across apps and banks. These efforts create a safer, more connected, and more competitive market.

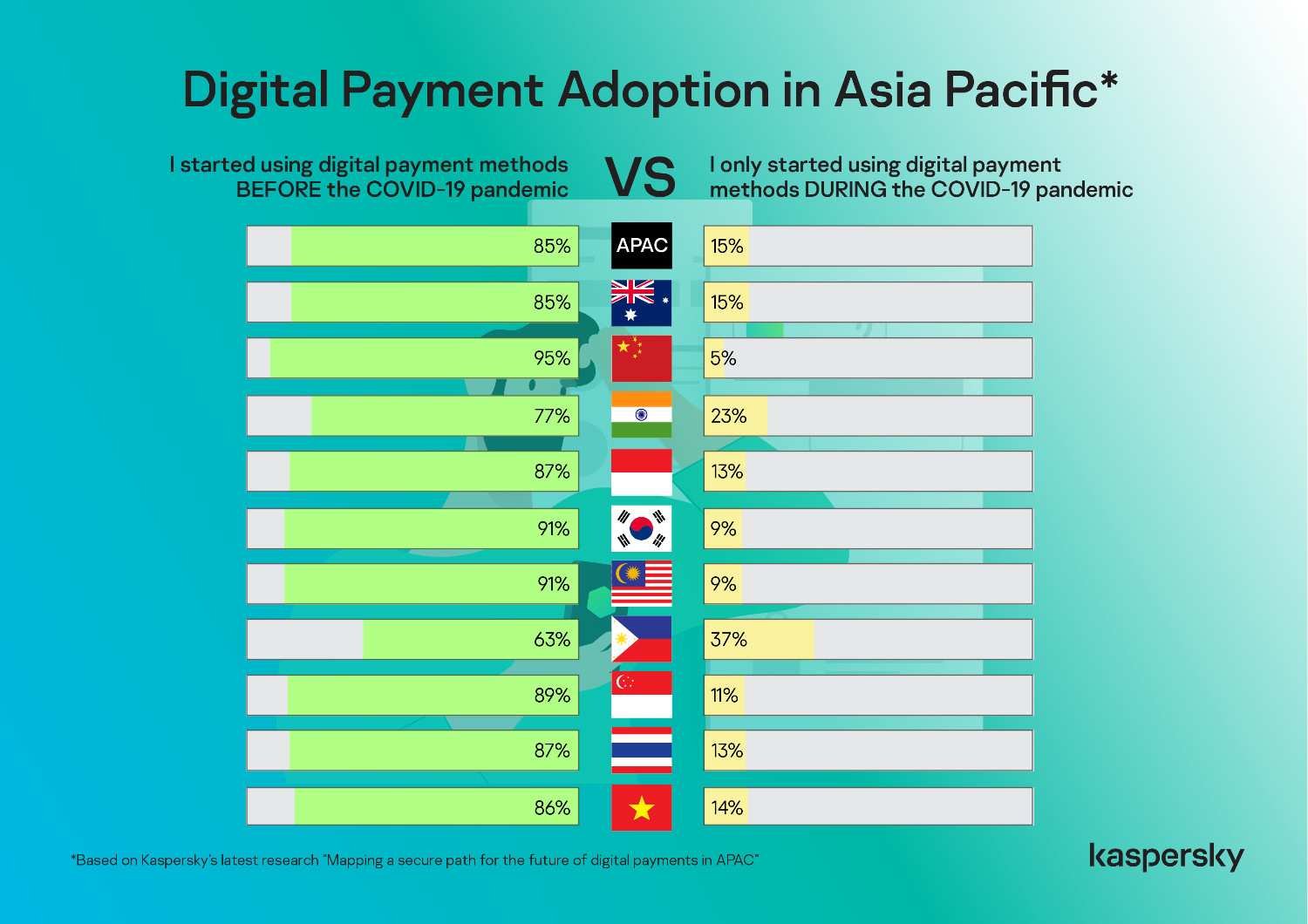

Digital payments tell a similar growth story. Back in 2018, only 10% of monthly retail transactions were digital. By the end of 2023, that number had jumped to 52.8%, surpassing the government’s targets for a cashless economy. This milestone proves how fast Filipino consumers have embraced financial technology.

Read Also: Philippines E-commerce Logistics Challenges to be Fixed

Trust and Volume in the Philippines Mobile Money Trends

Prepaid card and e-wallet transactions are expected to hit USD 4.42 billion in 2025, growing 8.8% year-on-year. This consistent rise signals one thing—trust. Filipinos are now more confident using digital platforms for everyday payments, bills, savings, and even investments.

Leading the charge is GCash, the country’s top e-wallet. By 2025, it surpassed 90 million registered users and processed over PHP 4 trillion in annual transactions. These numbers show that digital wallets are no longer a niche product; they are mainstream financial tools used across generations and income levels.

Innovation and Regulation Fuel the Future

In September 2025, the BSP approved three new digital banks, bringing the total to eight. This expansion fuels innovation and competition in financial services. It also strengthens trust, as licensed institutions must meet high regulatory standards for transparency and security.

Internet penetration, now close to 84%, ensures that even small businesses and independent workers can join the digital ecosystem. Whether it’s farmers receiving payments through mobile wallets or students sending money to family through apps, the system is working—fast, accessible, and inclusive.

Philippines Mobile Money Trends Show a Connected Digital Economy

From only 1% of total retail payments in 2013 to 52.8% in 2023, the Philippines’ digital payment share has skyrocketed. With mobile connections exceeding the total population and fintech adoption accelerating, the nation is positioning itself as a fintech leader in the region. The growth of digital finance is no longer a trend; it’s a movement that continues to reshape how Filipinos live and work.

To explore how your organization can adapt to and benefit from these Philippines Mobile Money Trends, contact Market Research Philippines. As a global consulting firm, Market Research Philippines helps businesses navigate digital transformation, scale financial innovation, and build sustainable strategies for growth.