The Philippines telecom tower expansion is back on track after years of slow growth. With a projected rise to 26,780 towers by 2025 and a CAGR of 1.97% through 2030, the country’s mobile infrastructure is entering a new era. This one is defined by 5G demands, private investment, and strategic consolidation. Let’s take a closer look!

From Stagnation to Recovery of the Philippines Telecom Tower Expansion

Between 2019 and 2024, the sector experienced a modest decline, with a negative CAGR of -1.64%. But now, rising data consumption and ongoing 5G deployment are changing the landscape. Major telecom hubs like Metro Manila, Cebu, and Davao are seeing heightened tower rollout activity, while efforts to bridge rural coverage gaps are expanding infrastructure into underserved provinces.

5G Rollout: Fueling Infrastructure Demand

At the heart of this expansion is the 5G rollout, which demands a denser, more advanced tower network. Unlike older networks, 5G requires towers that can handle higher frequencies and heavier bandwidth loads, particularly in urban environments where mobile usage is intense.

The market is also shifting away from rooftop setups to ground-based towers, which offer greater structural stability and better signal range. These upgrades are crucial to support high-speed services like streaming, remote work, and smart city applications.

Private Capital and Independent Tower Companies Step In

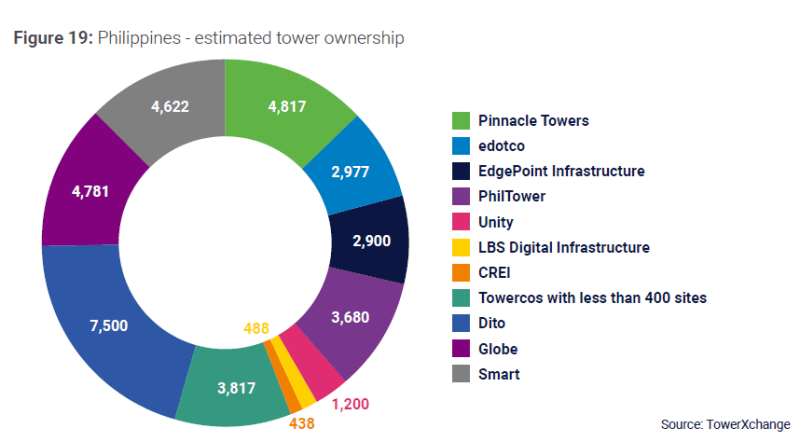

Another growth driver is the rise of independent tower companies (ITCs) like Transcend Towers and Phil-Tower Consortium. Backed by private equity, these players are buying and building towers at speed, bringing new capital and innovation to the table.

This surge in private sector participation is not only expanding tower numbers—it’s transforming the business model. Shared infrastructure is now standard practice.

Cost Savings Through Consolidation and Sharing

Instead of each telco building its own towers, companies like PLDT, Globe Telecom, and Converge are increasingly using colocation and tower-sharing strategies. This model reduces capital and operational expenses, speeds up deployment, and helps improve coverage in both urban and rural zones.

A 2022 study projected that such strategies could save up to $1.15 billion in capex and opex by 2025. This not only improves telco profitability but also means faster and more cost-effective service for consumers.

Philippines Telecom Tower Expansion Connecting a Nation

While large cities remain primary targets, the Philippines telecom tower expansion is also improving connectivity in remote towns where signal gaps persist. Thanks to regulatory support and market competition, more towers are going up in rural Luzon, Visayas, and Mindanao.

These moves are critical. In a country of more than 7,000 islands, reliable mobile coverage isn’t just about convenience—it’s about economic inclusion, education access, and emergency response.

Philippines Telecom Tower Expansion: Stronger Signals, Stronger Nation

The future of telecom in the Philippines is being built—literally—from the ground up. With 5G as the catalyst, private investment as the engine, and infrastructure sharing as the strategy, the country is well-positioned to close coverage gaps and enhance digital access for all. The Philippines telecom tower expansion is no longer a story of slow progress. It’s now a signal of growth, innovation, and nationwide transformation.

Have You Read: