The Freelance Economy Philippines is booming. Nearly 1.5 million Filipinos now work on global freelancing platforms. When you include local freelancing and informal e-commerce, the numbers rise even more. From 2019 to 2020, the freelance economy grew by 208%, the fastest growth in Asia. By 2021, nearly 20% of workers (about 8.7 million) earned income via online platforms.

In 2024, the digital economy made up ₱2.25 trillion, or 8.5% of GDP. E‑commerce alone contributed ₱302 billion, showing the economic power of digital entrepreneurship in the Philippines.

Freelance Economy Philippines Demographic: Young, Talented, and Growing

Youth is the backbone of the freelance surge. 55% of Filipino freelancers are aged 21-35, with another 28% aged 36-45. Youth labour force participation rose to 33.6% by May 2025, up from 32.2% a year before. This young, tech-savvy generation helped fast-track digital work, making freelancing a reliable income path, not just a pandemic stopgap.

Digital Platforms and Business Models

In the Freelance Economy Philippines, platforms like Facebook dominate as job sources. Many freelancers also use Instagram and gig platforms. Interestingly, content creators make up about 35% of the freelancing workforce, emphasizing how content-based models are popular.

About 69% of freelancers combine freelancing with running their own small businesses. Another 18% juggle multiple gigs at once, showing how digital work often blends with entrepreneurship.

Read Also: See Philippines Digital Economy Growth: Surprising Trends!

Freelance Economy Philippines Can Earn More Through Global Reach

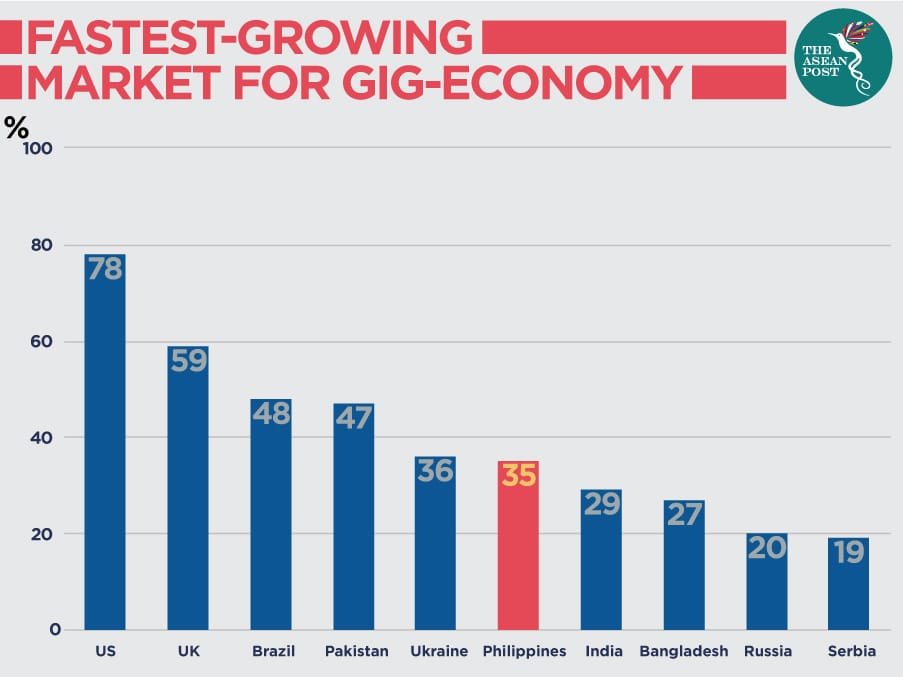

Filipino freelancers are capitalizing on global demand. They earn 57% more per hour when working for overseas clients versus local clients only. Many serve markets like the U.S., UK, Hong Kong, South Korea, Taiwan, and UAE—thanks to competitive labor costs and strong English skills.

This global reach is a key feature of the Freelance Economy Philippines, unlocking income and opportunity beyond borders.

Government Support & Financial Inclusion

The Philippine government acknowledges this shift. It hosts the annual Philippine Online Freelancing Conference and passed the Digital Workforce Competitiveness Act in 2022 (RA 11927). These efforts help upskill freelancers and formalize the sector.

Freelancer registration as businesses gives access to social security, health insurance, and bank services. This helps improve financial inclusion and protect digital workers.

Read Also: Philippines Rural Economy Digitization Unleashed

Freelance Economy Philippines: Challenges Facing Micro-Entrepreneurs

Despite growth, freelancers face hurdles. Many lack job security, benefits, paid leave, and retirement plans—making them vulnerable. In rural areas, internet access can be slow or unreliable. Also, competition from low-skilled work and the rise of AI tools threaten job stability for some.

The Path Forward

Still, the Freelance Economy Philippines offers immense promise. With strong demographics, government backing, and global market access, young entrepreneurs are carving out new paths. The sector will likely continue growing, bringing opportunities and structural shifts to the country’s labor landscape.

FAQs (Frequently Asked Questions)

Q1: What defines the Freelance Economy Philippines?

It refers to Filipinos earning income via online platforms—both global and local—across freelancing, e‑commerce, and content creation.

Q2: What are the top challenges for Filipino freelancers?

Common issues include lack of benefits, poor internet in rural areas, and vulnerability to AI-driven job disruptions.

Q3: How can freelancers gain access to financial services?

Registering as a business under RA 11927 opens opportunities for social security, health insurance, and formal banking.

Q4: Which platforms do Filipino freelancers use most?

Facebook is the leading source of freelance work, followed by Instagram and various gig platforms.